Real Estate Bubble Australia 2020

It is always demand and supply simple economics. December 10 2020 Philip Lee.

Learn About Real Estate Crowdfunding And Investing Without The Hassle Estate Planning Real Estate Marketing Investing

Zurich is a new addition to the bubble risk zone.

Real estate bubble australia 2020. January 22 2015 john. Few people pay cash for. However the common man doesnt know much about bubbles beyond their relationship to the recent economic collapse.

According to Mr Dent by looking at spending cycles and demographic caveats such as birth rates it is possible to gauge how economies will perform 30-50 years later when those demographic. Over the past few months economic indicators have been pointing to a recovery in the Australian housing market following an 18-month. Use our interactive Global Real Estate Bubble Index to track and compare the risk of bubbles in 25 cities around the world over the last three years.

A truly unique piece of Australian real estate is up for grabs. Today most experts agree that on a national level we are not in a real estate bubble. The home prices will continue to appreciate double-digits.

The general consensus is that Australias housing market has resumed its upward momentum during the last half of 2019 and is ready for solid growth in 2020. Risk is also elevated in Toronto Hong Kong Paris and Amsterdam. Baby Boomers wont cause the property crash its the banks toxic.

House prices in Australias major cities have been ballooning for over a decade. Australia recorded its strongest trade surplus of all time in March. Munich and Frankfurt top our list in 2020.

Real estate is by nature credit-driven. The biggest problems in Australia are overpriced real-estate values excessive consumer debt and an overweight banking sector with high real-estate exposure. Real estate activity has been going on at an unusual pace.

It used to be that homes selling in excess of 1 million were solely from the luxury end of the. Why Australias property prices will continue to soar. Meaning that by the 2020-2030 we first world countries will be competing for immigrants with the US.

Australia to lead global real estate bust. The real estate bubble has made prices beyond unaffordable but even a simple solution like a property tax could be a dire threat to the economy. Its down slightly to AUD 88 billion.

The residential property market remains overvalued and is approaching a tipping point an economist has said despite recent signs of a market rebound. Boom to Bust it is evidently clear that there is a chronic real estate bubble in Australia. Housing in Australia is still young growing market so bubble will burst scenario does to stack up.

Architect Graham Birchalls personal home based around a series of 11 intersecting bubble domes has. Australias housing boombubble could unravel badly. Youd expect contingency plans being formulated on how to deflate the real estate bubble without hurting the broader economy.

The housing sales recovery is strong as buyers are eager to purchase homes and properties that they had been eyeing during the shutdown. When most people read the term real estate bubble or housing bubble they likely think of the 2007-08 financial crisis. Property RealEstate HeiseSaysIs Australias Property Bubble ever going to pop or will the Government do everything they can to keep it goingCheck out Hei.

In 2021 interest rates are expected to remain low but would increase gradually. Real Estate Investing Advice Strategies From Experts You Can Trust.

79 Elanora Way Karalee Qld 4306 House For Sale Realestate Com Au In 2020 Bubble House Architect Acreage Living

Real Estate Crash Coming Housing Market 2020 Update Real Estate License Real Estate Prices Real Estate Marketing

Create A New Logo For An Australian Property Development Company Logo Design Contest Design Logo W Property Logo Design Company Logo Design Realtor Logo Design

Property Market Forecast 2022 House Prices Predictions From Expert

Sydney Australia Travel Get A Little Off The Well Worn Tourist Track With Some Of Our Hidden Gems Of Sy In 2020 Sydney Australia Travel Sydney Travel Australia Travel

Australian Property Market Home Prices Rent Prices Sydney Melbourne Brisbane Hobart Managecasa

Housing Market Predictions 2021 2022 Can It Crash Again

Australian Property Market Home Prices Rent Prices Sydney Melbourne Brisbane Hobart Managecasa

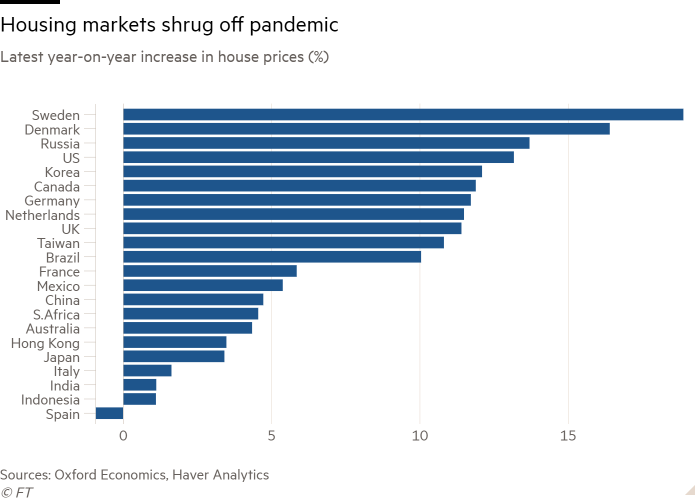

Runaway House Prices The Winners And Losers From The Pandemic Financial Times

History Of Housing Market Crashes And What They Mean For The Future

Australian Property Market Home Prices Rent Prices Sydney Melbourne Brisbane Hobart Managecasa

3 Reasons Why The Real Estate Market Boom Is Not A Bubble

5 Simple Graphs Proving This Is Not Like The Last Time Part I Graphing Real Estate Tips Financial Decisions

Vietnam S Economy Warns Of Asset Bubble In 2021 In 2021 Economic Research Economy Where To Invest

Real Estate Trends Bubble By Teo Nicolais Real Estate Trends Bubble By Teo Nicolais Sim Real Estate Trends Real Estate Investing Books Real Estate Marketing

A U S Housing Market Bubble 10 Years In The Making May Pop In 2020 10 Years Housing Market Bubbles

3 Reasons Why The Real Estate Market Boom Is Not A Bubble

The Most Splendid Housing Inflation Bubbles In America With Wtf Spikes In Seattle Los Angeles Wolf Street

Posting Komentar untuk "Real Estate Bubble Australia 2020"