Real Estate Bubble Global Financial Crisis

Predatory lending targeting low-income homebuyers excessive risk-taking by global financial institutions and the. Consumers expect prices to increase further so.

History Of Housing Market Crashes And What They Mean For The Future

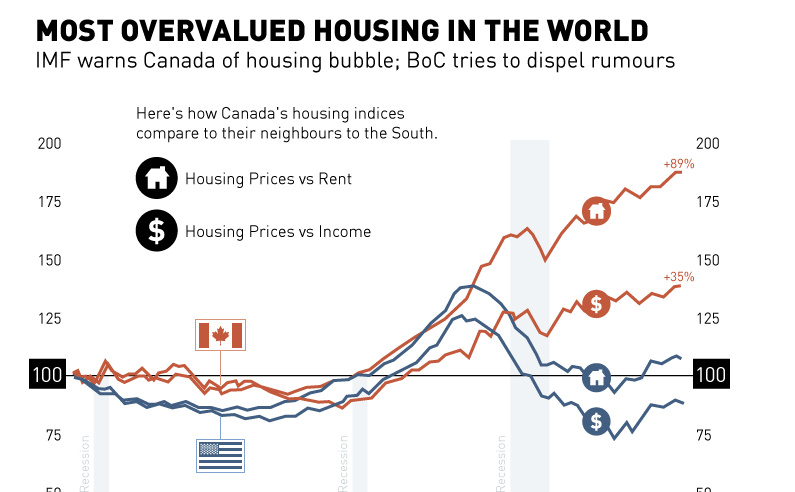

Prices just outside of frothy Canadian real estate markets are growing much faster than in the city.

Real estate bubble global financial crisis. Dodd-Frank put in place real guardrails against re-creating the kind of financial crisis we saw in 2008 We are now in the bubble expansion phase. 3 What should be done to stop it or to minimize the damage. It is the strongest film explanation of the global financial crisis.

Zimmerman outside the Charleston home she owned for 12 years before Hurricane Irma severely damaged it. Quoted economists and real estate industry representatives arguing there was no bubble and nothing to fear but there are. If it bursts it could cause a crisis like the one that bankrupted Lehman.

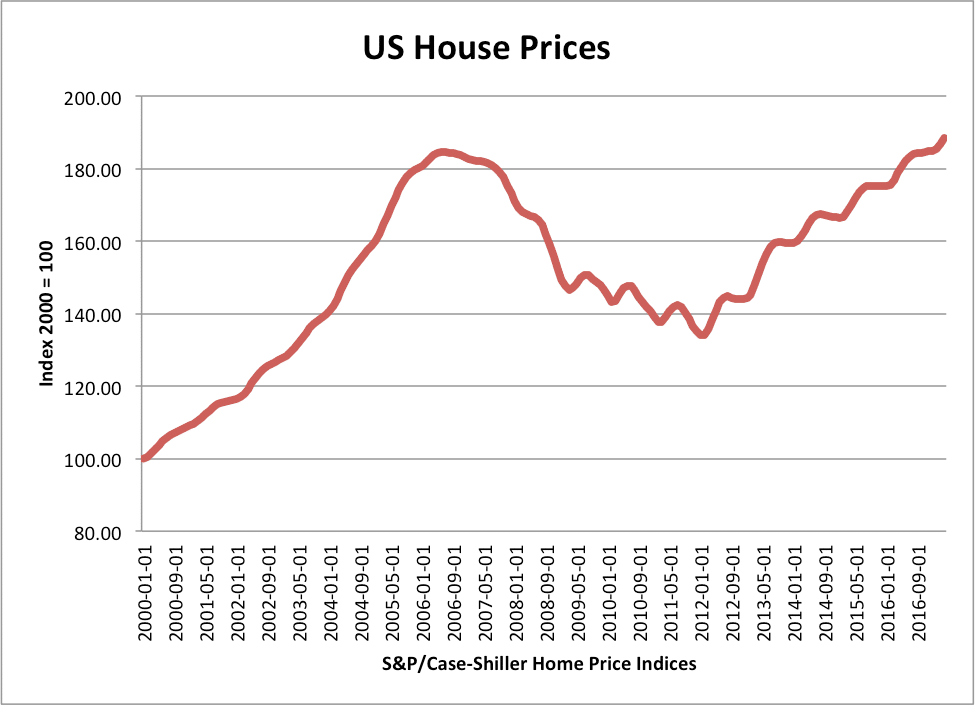

Also known as a real estate bubble a housing bubble occurs when home prices rise at a rapid rate to a level of instability. In 2007 the US. Subprime mortgage market collapsed sending shockwaves throughout the market.

Further investigation is required. 1 What started the econom-ic crisis. Thats typical of a bubble and its called housing bubble contagion.

The Climate Real Estate Bubble. Prices will increase builders will build but by 2020 the US Economy will enter a recession and by 2024 the RE market will break down. The shift in debt had impacts on real estate and financial asset prices price instability expenditures on goods and services labor productivity wage growth income inequality and was the.

The lack of evidence supporting the widely accepted theory of a real estate bubble as the cause of the Global Financial Crisis of 2007 and 2008 raised questions regarding the existence of a real estate bubble preceding the Global Financial Crisis of 2007 and 2008. In 2008 a collapse in housing prices triggered a global financial crisis. June 19 2021.

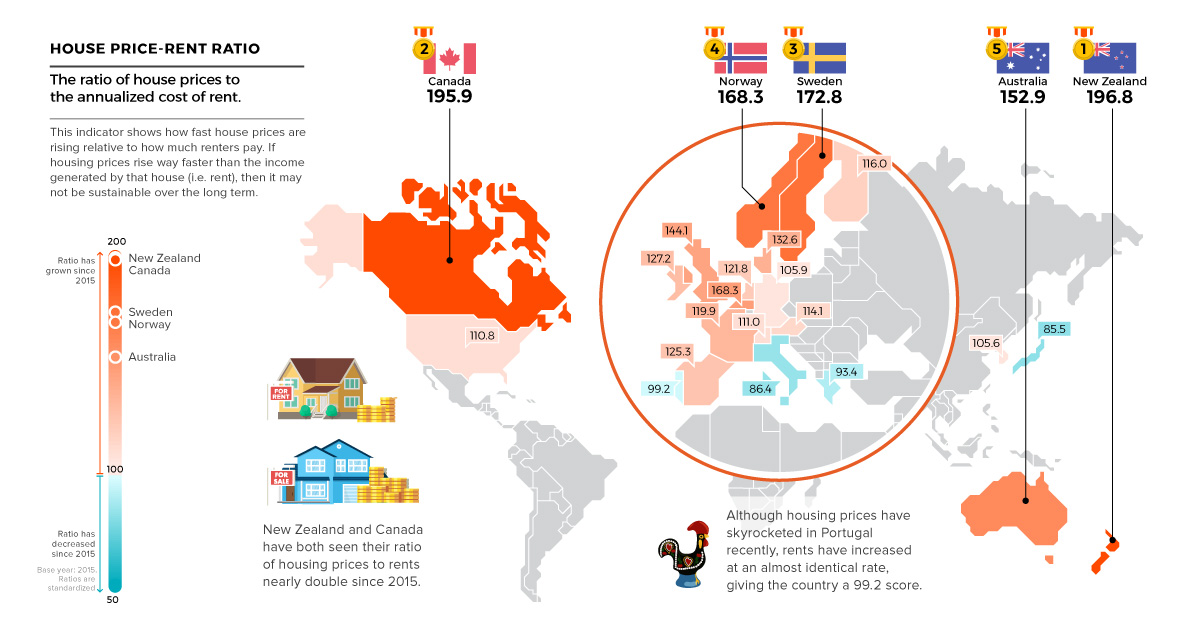

The International Monetary Fund IMF has warned that rising interest rates in the United States could trigger overpriced assets such as Australian property to unwind in a. In a paper titled Housing Bubble Contagion From City Centre To Suburbs three Taiwan-based researchers argue bubbles spread outwards. The financial crisis of 2007-2008 was the worst to hit the world since the stock market crash of 1929.

On the Verge of Another Financial Crisis. 2 How long will it continue. John Macomber a senior lecturer at Harvard Business School believes history may be about to repeat itself this time.

As the prices start rising speculation begins to take effect. Housing bubbles generally begin when there is a shortage of inventory and an increase in demand in a market. Issues The current economic crisis has called for the examination of three important questions.

House prices have skyrocketed to the point that they may be artificially inflating and forming a dangerous bubble. Real estate bubbles can create for local governments particularly those that rely heavily on property tax revenues. The financial crisis of 20072008 also known as the global financial crisis GFC was a severe worldwide economic crisisPrior to the COVID-19 recession in 2020 it was considered by many economists to have been the most serious financial crisis since the Great Depression.

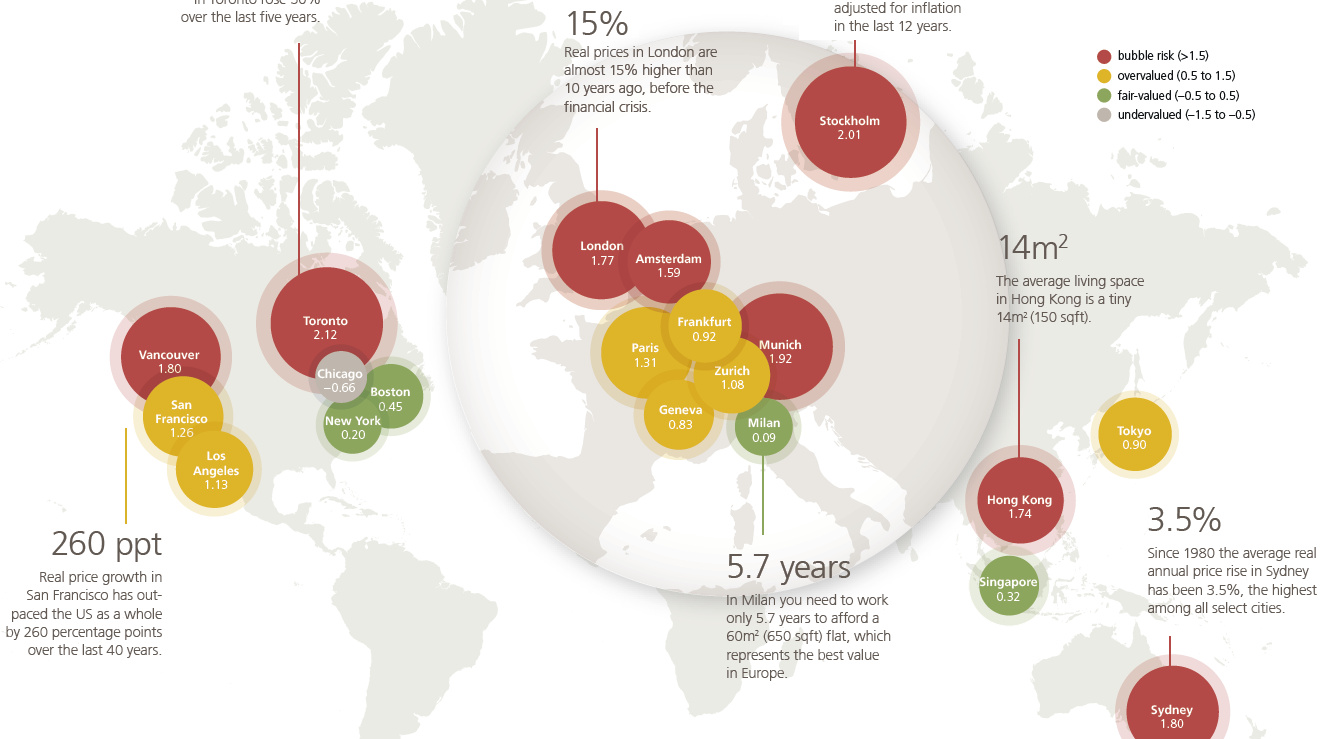

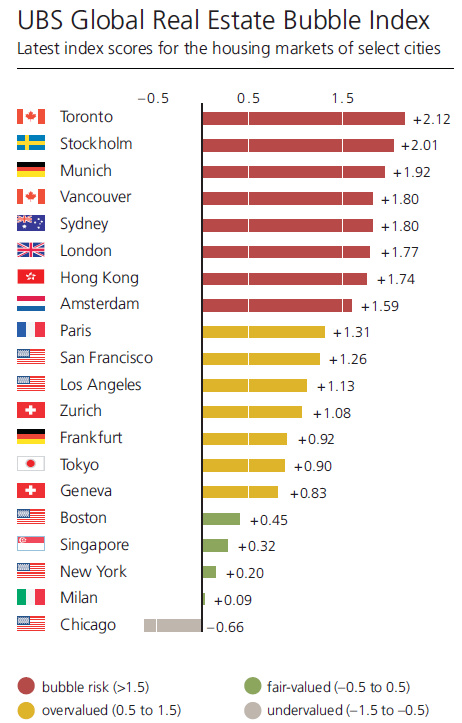

Real Estate Bubbles The 8 Global Cities At Risk

Over 10 Years Later Lessons From The Financial Crisis

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

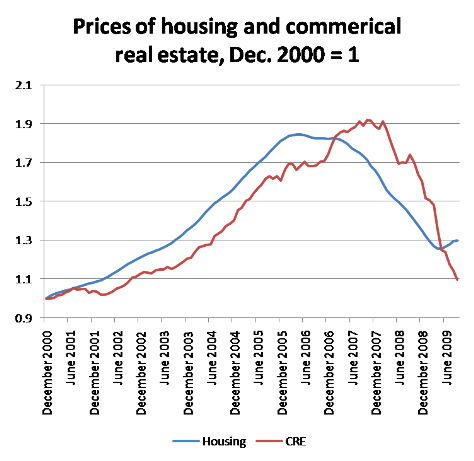

Was There A Commercial Real Estate Bubble The New York Times

Why Did The House Prices Fall During The Global Financial Crisis Quora

Canada Has The Most Overvalued Housing Market In World Chart Visual Capitalist

Why The Housing Bubble Tanked The Economy And The Tech Bubble Didn T Fivethirtyeight

Real Estate Bubbles The 8 Global Cities At Risk

Types And Causes Of Financial Bubbles Economics Help

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Why The Housing Bubble Tanked The Economy And The Tech Bubble Didn T Fivethirtyeight

The Post 2009 European Housing Bubble

Financial Crisis Bank Fines Hit Record 10 Years After Market Collapse Business Economy And Finance News From A German Perspective Dw 10 08 2017

The Post 2009 European Housing Bubble

Mapped The Countries With The Highest Housing Bubble Risks

Chart Which Cities Have The Highest Risk Of A Housing Bubble Statista

Toronto Ranks 3rd In The World For Cities Most At Risk Of Real Estate Bubble Urbanized

Posting Komentar untuk "Real Estate Bubble Global Financial Crisis"