Real Estate Bubble History

February 28 2008 at 1222 pm analysis may remind you of Deejayohs excellent post that compared disposable income. This period during the run up to the crash is also known as froth.

Us Real Estate 100 Year Inflation Adjusted Trend Historical Charts January 2012 About Inflation Us Real Estate Chart Real Estate

Financial and banking system.

Real estate bubble history. Less well known and far less well documented is the nationwide real estate bubble that began around 1921 and deflated around 1926. There was the Los Angeles real estate bubble of the 1880s when real land prices increased 10-fold from 1882 to 1888 and then fell by one-third in one year the next year 1889. Interest rates started to fall in the mid-1980s.

As a quick fix to end the recession. For the first 144 years of real estate enclosure in the US land. Avoiding the Real Estate Bubble Explosion of 2007 through 2011 Frank and Teresa were allowed the freedom to explore what a Real Estate Business would look like when the industry recovered.

The rates are still laughable by todays standards - 10 or more. His background in engineering and computer internet technology a fondness of data-based analysis of problems and an addiction to spreadsheets all influence his perspective on the Seattle-area real estate market. Real Estate prices in Seattle went up almost linearly if you take a regression analysis average from the time of Reagans deregulation of banks in 1990 to todays 2008 subprime mess.

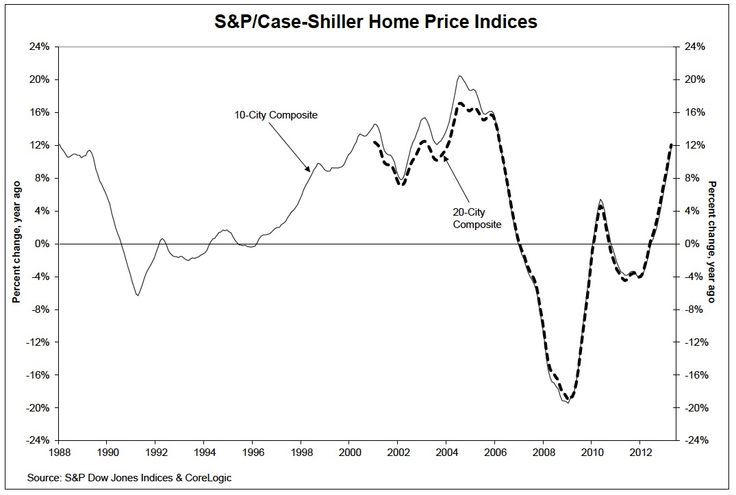

Even though the population of Los Angeles was skyrocketing at the time real estate prices still. The stage was set for the Real Estate bubble of the 1980s. The Great Recession was largely caused by the bursting of the mid-2000s housing bubble and the damage it caused in the US.

Tim Ellis is the founder of Seattle Bubble. Hence home prices did not. From 1990 on bank deregulation unfetterred capitalism caused the endless real estate bubble to todays subprime mess Tims graph makes it clear.

King County Affordability. There was the Los Angeles real estate bubble of the 1880s when real land prices increased 10-fold from 1882 to 1888 and then fell by one-third in one year the next year 1889. A real-estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real-estate markets and typically follow a land boom.

That four year period of time was spent visualizing and building a new business model a model we believe will be the future of the Real Estate Industry. A land boom is the rapid increase in the market price of real property such as housing until they reach unsustainable levels and then decline. ARM Loans Boom During the Early 2000s Bubble.

Anderson sent us an illuminating analysis of real estate bubbles through US. The famous stock market bubble of 19251929 has been closely analyzed. When the housing bubble was still inflating ARM loans were a popular option because they offered a low upfront payment many people believed housing prices only go up - home ownership was after all the American dream.

But this represented a huge drop from the sky-high rates of the early 1980s. In the last great debt bubble in the US. That peaked in 1929 the average household could not afford a house and had to put down 50 and get a 5-year balloon mortgage.

Reader and financial blogger Philip J. Tim also hosts the weekly improv comedy sci-fi podcast Dispatches from the Multiverse. 1950-2007 Seattle Bubble News discussion about real estate the housing bubble in the Seattle area.

A real estate bubble occurs when home prices escalate beyond what can explained by the fundamentals like mortgage rates population growth or household income growth explains Taylor Marr. The questions of whether real estate bubbles can be identified.

Average Toronto Housing Prices From 1967 To 2018whats Going To Happen Next Real Estate Prices Toronto Houses House Prices

Toronto House Prices Financial Coach Marketing Investing

2016 Year In Review Peak Prosperity Bubbles Bubble Chart Housing Market

Sf Rents And Nasdaq Nasdaq Commercial Real Estate Francisco

This Will Be The Largest Evaporation Of Wealth In Modern History Modern History Wealth Evaporation

Pin By Do Thanh On Investing Kinh Te Hoc Bond Market Bond Marketing

Bearmarket Bearmarketprotection Bubble Dia Diatradesignals Dowjonestradingsignals Housingbubble Nasdaq Effects Of Inflation Bear Market Trading Signals

How To Determine Where We Are In The Real Estate Market Cycle Real Estate Marketing Finance Investing Marketing

S 500 Earnings Chart Rebounding All About Time

How Housing Prices Have Changed Ten Years After The Real Estate Bubble Burst Vivid Maps Economic Map House Prices Map

Real Estate Bubble How To Get Rich Real Estate Melbourne House Prices

Stock Market Chart From 2016 To Now Stock Market Chart Us Stock Market Stock Market

Graph Of Real Estate Cycle S Four Quadrants Recovery Expansion Hyper Supply Recession Real Estate Trends Real Estate Investing Books Real Estate Marketing

Us Home Prices Soared In April And Had Their Best Month In The History Of The Case Shiller Index Charts And Graphs Chart House Prices

Year Over Year Rental Prices On The Rise With Average Rents Continuing To Rise Now May Be A Real Estate Values Current Mortgage Rates Real Estate Information

Zillow Home Values To Grow 22 Percent Through 2017 House Prices Home Values Zillow

Case Shiller Chicago Area Home Price Gains Lag The Nation Chicago Condos House Prices Chicago Area

The Majority Of Home Purchases Are Now Being Done By Cash Buyers Destroying The Myth That Cash Buyers Are A Small P Economic Trends Cash Buyers Moving Average

Chart Of The Day The Most Overvalued And Undervalued Housing Markets In The Developed World Real Estate Marketing Plan Housing Market Chart

Posting Komentar untuk "Real Estate Bubble History"