Real Estate Bubble Of 2007-08 In Us

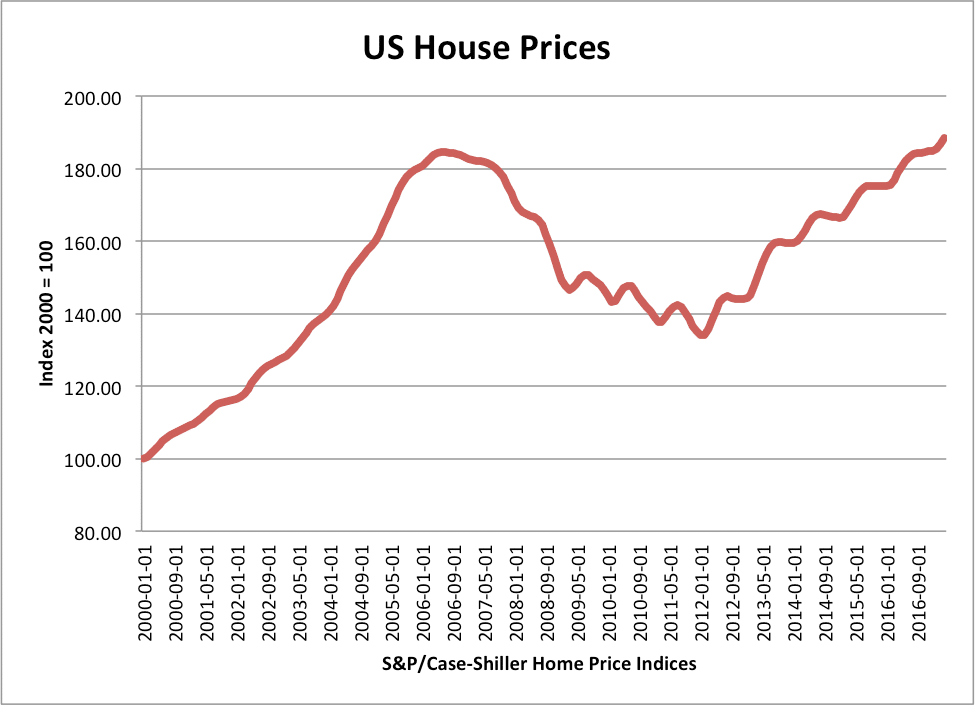

The financial crisis of 200708 was related to the bursting of a real estate bubble which had begun during the 2000s. The National Association of Realtors forecast home sales would fall to 618 million in 2007 and 641 million in 2008.

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Population could form.

Real estate bubble of 2007-08 in us. There was the Los Angeles real estate bubble of the 1880s when real land prices increased 10-fold from 1882 to 1888 and then fell by one-third in one year the next year 1889. Is not about to see a rerun of the housing bubble that formed in 2006 and 2007 precipitating the Great Recession that followed according to experts at Wharton. As the housing bubble burst it affected banks and financial institutions who were betting on the continued increase in home prices.

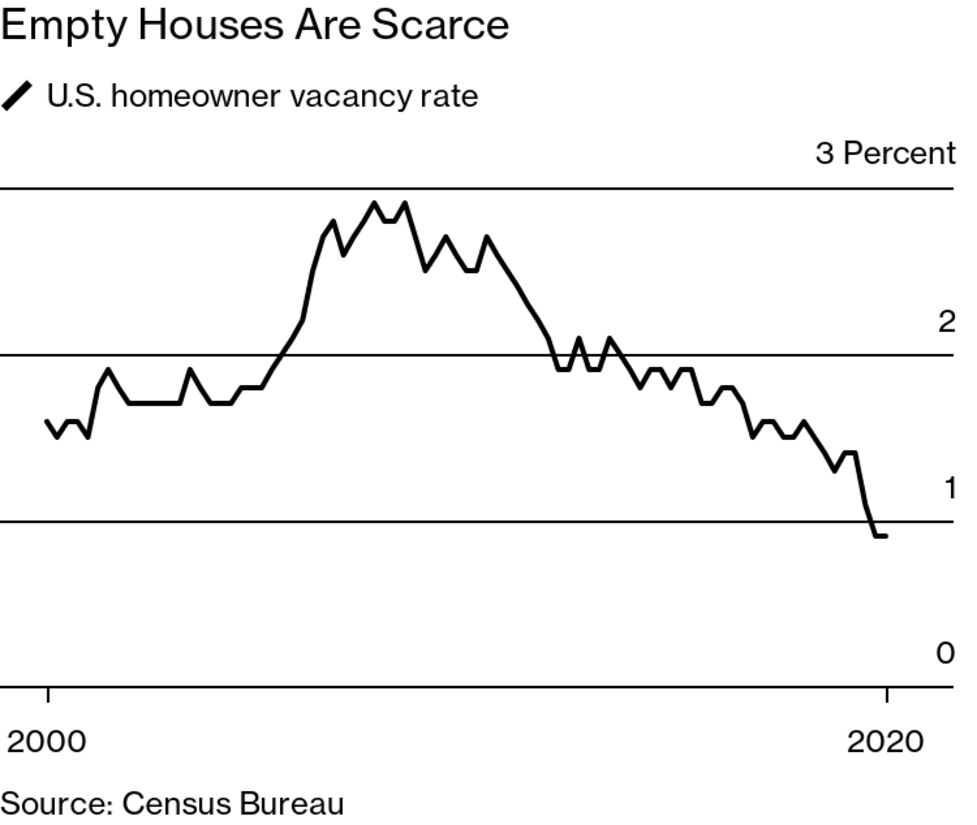

The stock market crash of 2008 was a result of a series of events that led to the failure of some of the largest companies in US. Housing bubbles usually start with an increase in demand in the face of limited supply. A housing bubble is a run-up in housing prices fueled by demand speculation and exuberance.

The peak of the homeowner vacancy rate at just shy of 3 was 2007-08 when there really was a bubble in the market. Housing bubbles usually start with an increase in demand in the face of limited supply which takes a relatively extended period to replenish and increase. When the bubble burst financial institutions were left holding.

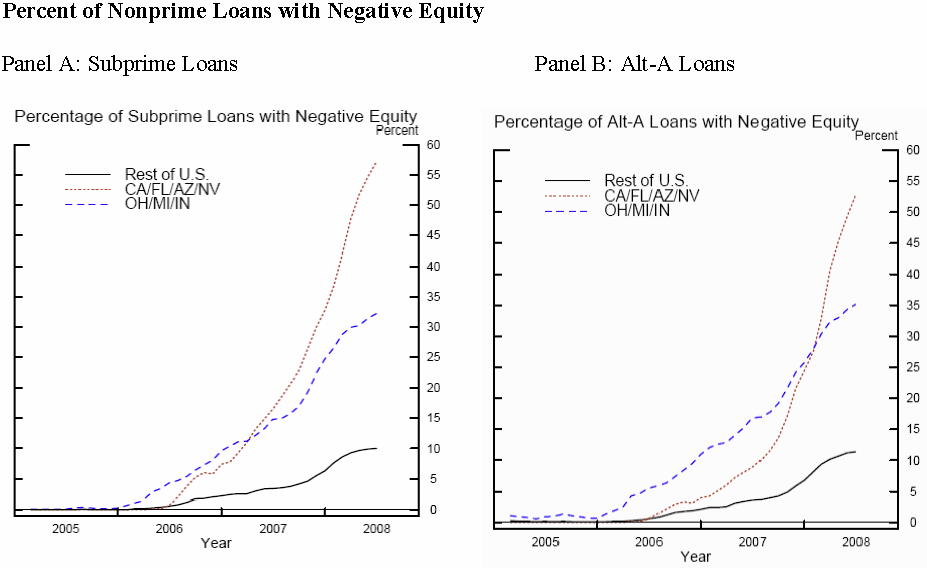

Government-sponsored mortgage lenders Fannie Mae and. The stock market and housing crash of 2008 had its origins in the unprecedented growth of the subprime mortgage market beginning in 1999. 1 2 It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Even though the. That was lower than the 648 million sold in 2006. The 2007-2009 financial crisis began years earlier with cheap credit and lax lending standards that fueled a housing bubble.

It was lower than the NARs May forecast of 63 million sales in 2007 and 65 million sales in 2008. A housing bubble or real estate bubble is a run-up in housing prices fueled by demand speculation and exuberant spending to the point of collapse. Builders were putting up houses faster than the US.

30 2008 the Case-Shiller home price index reported its largest. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Mortgage debt as a percentage of disposable income peaked at more than 72 in late 2007 according to the Federal Reserve.

That closely watched metric of leverage stood at just 345 in early 2021.

Check Out The Prices Of Those Dolls Barbie Vetements Barbie Vintage Tenues Barbie

Pdf A Stochastic Approach To Model Housing Markets The Us Housing Market Case

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Crisis Of 2007 08 Home Ownership Money Lender Hard Money Lenders

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Beatles Yellow The Beatles Yellow Submarine

Bubble Ponic System Poor Mans Hydro Garden Hydro Gardening Hand Soap Bottle Donut Glaze

Types And Causes Of Financial Bubbles Economics Help

Was There A Housing Price Bubble Revisited Marginal Revolution

/GettyImages-668600179-a5321a6fa651488d80c27b0f52bd39b8.jpg)

The Fall Of The Market In The Fall Of 2008

Pin On Cool Diy Projects To Try

This Chart Should Assuage Fears Of A Housing Bubble Bloomberg

United States Housing Bubble Wikiwand

Housing Market Crisis 2 0 The Jury Is In For 2018 2019 Seeking Alpha

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Housing Stats Covering The Financial Impacts Of The United States Housing Bubble The Great Recession Real Estate Bubbles In Context

Posting Komentar untuk "Real Estate Bubble Of 2007-08 In Us"